The Definitive Guide to Guided Wealth Management

Table of ContentsGuided Wealth Management Can Be Fun For EveryoneGuided Wealth Management for Beginners9 Simple Techniques For Guided Wealth ManagementGuided Wealth Management Fundamentals Explained6 Simple Techniques For Guided Wealth Management6 Simple Techniques For Guided Wealth Management

Selecting an effective monetary consultant is utmost important. Advisor functions can vary depending on several elements, including the kind of economic advisor and the customer's demands.Independent recommendations is impartial and unlimited, yet limited recommendations is limited. Consequently, a restricted expert ought to declare the nature of the limitation. If it is vague, much more concerns can be raised. Conferences with customers to review their financial sources, appropriations, requirements, revenue, expenditures, and planned objectives. best financial advisor brisbane. Offering suitable strategies by examining the background, economic information, and abilities of the client.

Giving critical strategy to collaborate individual and organization financial resources. Guiding clients to carry out the economic strategies. Reviewing the executed plans' efficiency and upgrading the applied plans on a regular basis often in different stages of clients' growth. Normal monitoring of the financial profile. Maintain monitoring of the customer's tasks and verify they are following the right path. https://disqus.com/by/guidedwealthm/about/.

If any type of issues are come across by the monitoring consultants, they arrange out the source and resolve them. Build a financial threat analysis and review the possible impact of the danger. After the completion of the danger analysis version, the consultant will analyze the outcomes and supply an ideal remedy that to be implemented.

Unknown Facts About Guided Wealth Management

In many countries experts are employed to save time and reduce stress. They will assist in the achievement of the monetary and workers objectives. They take the duty for the provided decision. Because of this, clients need not be concerned concerning the choice. It is a long-lasting procedure. They need to examine and analyze more areas to line up the ideal path.

However this caused an increase in the internet returns, price financial savings, and additionally directed the course to success. Several procedures can be contrasted to recognize a qualified and skilled advisor. Normally, experts require to satisfy common scholastic qualifications, experiences and qualification suggested by the federal government. The fundamental academic certification of the expert is a bachelor's level.

While seeking an advisor, please think about credentials, experience, abilities, fiduciary, and payments. Browse for clarity till you get a clear idea and complete contentment. Always guarantee that the recommendations you receive from a consultant is always in your best interest. Eventually, financial advisors take full advantage of the success of a service and likewise make it expand and grow.

What Does Guided Wealth Management Mean?

Whether you require somebody to assist you with your tax obligations or supplies, or retired life and estate planning, or all of the above, you'll find your answer below. Keep reading to discover what the difference is between a monetary expert vs coordinator. Essentially, any kind of professional that can help you manage your cash in some fashion can be thought about an economic consultant.

If your objective is to produce a program to satisfy long-lasting economic goals, then you most likely desire to get the services of a qualified financial coordinator. You can look for a planner that has a speciality in taxes, investments, and retired life or estate preparation.

A monetary consultant is just a wide term to explain a specialist that can assist you handle your money. They might broker the sale and acquisition of your supplies, handle investments, and help you create a thorough tax obligation or estate strategy. It is vital to keep in mind that an economic advisor should hold an AFS certificate in order to serve the public.

All About Guided Wealth Management

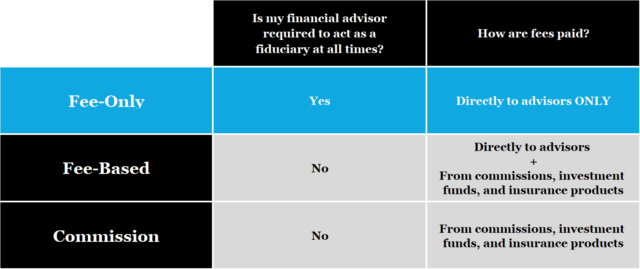

If your monetary advisor listings their solutions as fee-only, you need to expect a checklist of services that they supply with a malfunction of those fees. These experts don't supply any type of sales-pitch and normally, the solutions are reduced and completely dry and to the point. Fee-based advisors bill an in advance fee and afterwards earn commission on the economic items you acquire from them.

Do a little research initially to be certain the financial expert you hire will have the ability to deal with you in the long-term. The most effective area to begin is to ask for referrals from family members, close friends, co-workers, and neighbors that are in a comparable monetary circumstance as you. Do they have a trusted economic advisor and exactly how do they like them? Requesting references is an excellent way to be familiar with an economic expert before you even satisfy them so you can have a better concept of exactly how to manage them in advance.

Unknown Facts About Guided Wealth Management

You should always factor expenses into your financial check my blog planning circumstance. Carefully assess the fee frameworks and ask concerns where you have confusion or concern. Make your possible expert answer these questions to your contentment prior to moving on. You may be seeking a specialty consultant such as somebody that concentrates on separation or insurance coverage preparation.

A financial expert will certainly help you with setting possible and practical goals for your future. This can be either beginning an organization, a household, preparing for retirement all of which are crucial chapters in life that require mindful factor to consider. An economic expert will take their time to review your situation, short and long term objectives and make referrals that are appropriate for you and/or your family members.

A study from Dalbar (2019 ) has actually shown that over twenty years, while the ordinary financial investment return has been around 9%, the average investor was just getting 5%. And the distinction, that 400 basis factors annually over twenty years, was driven by the timing of the financial investment decisions. Handle your profile Protect your properties estate preparation Retirement planning Handle your very Tax obligation investment and management You will certainly be called for to take a threat tolerance set of questions to provide your advisor a clearer picture to identify your financial investment asset allocation and choice.

Your advisor will analyze whether you are a high, medium or reduced risk taker and established up an asset appropriation that fits your risk tolerance and capacity based on the info you have actually supplied. As an example a high-risk (high return) person might spend in shares and home whereas a low-risk (reduced return) individual may wish to spend in cash money and term deposits.

Our Guided Wealth Management Ideas

For that reason, the more you save, you can select to invest and develop your wide range. As soon as you engage a financial consultant, you don't need to handle your portfolio (financial advisor brisbane). This saves you a lot of time, effort and power. It is vital to have correct insurance plan which can give assurance for you and your household.

Having a monetary advisor can be extremely advantageous for many individuals, but it is very important to weigh the benefits and drawbacks before deciding. In this write-up, we will certainly explore the advantages and disadvantages of collaborating with an economic advisor to assist you choose if it's the best relocation for you.